Table of Contents

Cities are constantly evolving, and with global markets shifting, real estate remains one of the most resilient and rewarding sectors for investors. Whether you are seeking long-term capital growth, rental yields, or diversification, the right city can provide unmatched opportunities. This year, several cities stand out as promising hubs for both residential and commercial property investment, shaped by factors such as infrastructure development, economic stability, population growth, and favorable government policies.

Why Focus on Cities for Real Estate Investment?

Cities often act as the heartbeat of economic activity, attracting both local and international investors. With rising urbanization, real estate demand is growing, driven by increasing populations and expanding industries. By targeting specific cities, investors can capitalize on growth trends while minimizing risks. Choosing wisely ensures not only higher returns but also long-term portfolio stability.

Best Cities to Consider This Year

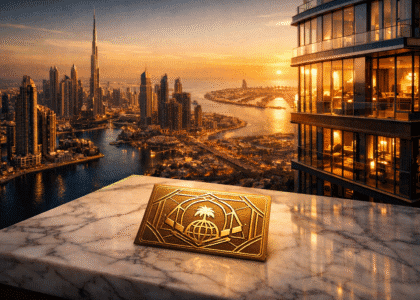

- Dubai, UAE

Dubai continues to dominate the global real estate market, thanks to its tax-free policies, futuristic infrastructure, and high rental yields. Investors are drawn to luxury residences, commercial hubs, and short-term rental markets fueled by tourism. The city’s strong connectivity and visionary projects make it one of the most reliable choices this year.

- London, UK

London remains a classic investment destination, even with market fluctuations. Its property values may appear steep, but the city’s international appeal and consistent demand for rentals ensure long-term growth. With its role as a global financial hub, London offers security and prestige for investors.

- New York City, USA

New York City continues to be a magnet for real estate investors. Known for its diverse neighborhoods and strong rental market, it offers opportunities across residential, commercial, and mixed-use developments. Its global recognition ensures property value resilience.

- Singapore

Singapore has earned its spot as one of Asia’s most stable real estate markets. With strong governance, strict regulations, and a thriving economy, the city attracts investors looking for safe and secure options. Its real estate market benefits from consistent demand due to limited land availability.

- Toronto, Canada

Toronto is experiencing rapid population growth, driven by immigration and economic expansion. With rising housing demand, property prices and rental yields are climbing. Investors find opportunities in both residential and commercial real estate, supported by government stability.

- Sydney, Australia

Sydney has always been an attractive investment market, offering high-quality living and a robust economy. Strong demand from both domestic and international buyers keeps property values competitive. Infrastructure projects and limited supply continue to make Sydney a solid choice.

- Berlin, Germany

Berlin is emerging as a hotspot due to its affordability compared to other European capitals. Its booming tech industry and cultural significance are driving demand for residential spaces. With rental yields outperforming many other European cities, Berlin offers long-term growth potential.

Key Factors Driving These Cities

Several reasons make these cities the best bets for investors this year:

- Economic Growth: Strong and stable economies drive consistent property demand.

- Infrastructure: Mega projects and urban development boost property values.

- Rental Demand: Cities with growing populations and tourism ensure high occupancy rates.

- Government Policies: Investor-friendly regulations, tax benefits, and foreign ownership rules play a vital role.

- Global Connectivity: Cities with international appeal attract steady investment flows.

Tips for Choosing the Right City

- Research property trends and market cycles before investing.

- Consider rental yields alongside long-term appreciation potential.

- Analyze government regulations on foreign ownership.

- Look at the stability of the local economy and job market.

- Seek professional advice to balance risks with returns.

Conclusion

Cities are the engines of global real estate growth, and identifying the right one can significantly shape your investment journey. This year, Dubai, London, New York City, Singapore, Toronto, Sydney, and Berlin emerge as the frontrunners for strong returns and sustainable growth. By aligning your strategy with market trends and focusing on stable cities, you can build a profitable and resilient portfolio.

✅ Ready to Make the Smart Move?

Explore our latest smart home listings or book a free consultation with a Heptagon advisor today. Let’s help you find a home that’s not just modern—but future-ready.

Call us: +971 50 203 5824

Email: info@heptagonproperties.com

Website: https://heptagonproperties.com

Check out our contracting company: https://charminardubai.com/

Follow us on Instagram | LinkedIn | YouTube | Facebook | Tiktok

Frequently Asked Questions (FAQs)

Which city offers the highest rental yields this year?

Dubai stands out for offering some of the highest rental yields globally, especially in prime residential and short-term rental markets.

Are European cities still a safe investment option?

Yes. Cities like Berlin and London remain strong choices due to their international appeal and stable demand, though regulations may vary.

Should I prioritize capital appreciation or rental income?

This depends on your financial goals. Cities with rapid growth often offer better appreciation, while others provide steady rental returns.

Is it safe to invest in emerging cities?

Emerging cities may offer higher returns but come with greater risks. Always balance them with established markets to minimize exposure.

How do I start investing in international cities?

Begin by consulting real estate experts, researching local laws, and exploring financing options. Partnering with reliable agencies helps ensure smoother transactions.